-

3 key predictions for Vietnam’s ecommerce industry in 202013/02/20202019 was a year of many surprises for the Vietnamese ecommerce sector: New ambitious players joined the heated space, previously formidable companies abruptly left the market, and big brands made strong positive movements in the sector.

3 key predictions for Vietnam’s ecommerce industry in 202013/02/20202019 was a year of many surprises for the Vietnamese ecommerce sector: New ambitious players joined the heated space, previously formidable companies abruptly left the market, and big brands made strong positive movements in the sector.

With that starting point, 2020 promises to be an especially exciting year for the industry. Here are three predictions about where Vietnamese ecommerce might be heading, according to analysts from iPrice Group.

.jpg)

An increased focus on profitability instead of growth

Everybody in the business world knows what happened to WeWork in 2019 and how it has affected investors’ confidence. Investors have become more cautious than ever and want to make sure that they are putting money into companies that have real potential and sustainability.

Asia and its highly celebrated unicorns are especially vulnerable to these changes. Last December, Indian ride-hailing company Ola reduced overall staff strength by 5% to 8%. Oyo, another fast-growing Indian startup, recently had to let go of thousands of employees as well.

In Southeast Asia, Indonesian unicorn Bukalapak has also been restructuring its company by laying off portions of its workforce due to incoming demands from investors. Teddy Oetomo, the ecommerce firm’s chief strategy officer, said it loud and clear: “Our focus is no longer growth, but to build a sustainable company.”

In Vietnam, this trend is taking shape in 2019 with two ecommerce companies closing their online marketplaces to focus more on profitable business sectors. Lotte.vn will shut down amid plans to change its retail strategy. Another ecommerce website that has been affected is local conglomerate Vingroup’s Adayroi – it is also said to be shifting to the “new retail” model.

Looking at the remaining major ecommerce players in the country, it’s easy to see that most of them are reliant on investor money. Shopee Vietnam, Lazada Vietnam, Tiki.vn, and Sendo – the four most visited online marketplaces in Vietnam – all reported huge losses in 2018 and then continued to raise more money from foreign investors in 2019.

These companies will soon have to start thinking about shifting their business models toward generating profit, instead of growing traffic or number of users, or they risk meeting the same fate as Lotte.vn and Adayroi.

Extra effort on infrastructure

Dissatisfaction in the delivery experience is common in Southeast Asian ecommerce. According to a study by iPrice and Parcel Perform, 34.1% of ecommerce users in the region are still unsatisfied with the quality of parcel delivery services they received. In Vietnam, the study found that it takes 5.6 days for a parcel to reach its buyer, the second slowest in the region.

Noticing the high demand among ecommerce consumers for speedy and timely delivery, the top ecommerce companies in the country are racing to improve its delivery speed using various strategies.

Most notably, Tiki introduced TikiNow, a shipping policy that promises to deliver products within two hours. In order to execute the strategy, the ecommerce startup requires sellers to keep all items at its warehouses. On top of this, it is also investing money into warehousing by signing a deal with Unidepot, a logistics provider which has 35,000 square meters of warehousing space in the country.

Tiki’s new strategy has leveled up the standard of delivery services in Vietnam, which has forced competitors to launch faster delivery policies. Shopee now offers delivery in four hours, and Sendo took it one step further by offering delivery in three hours.

Looking at 2020, delivery infrastructures will continue to play an important part in consumers’ choice, and there will be more focus on competition between companies. Data from a 2019 Q&Me report shows that fast delivery is still firmly among the top five reasons for online shopping among Vietnamese coming into 2020.

Quick, punctual, and responsive customer service and delivery might even become a deciding factor in the ecommerce space.

Customers’ needs becoming more niched and diverse

While 2019 marked the downfall of some ecommerce businesses in Vietnam, it also marked the emergence of other smaller but more effective ones.

One notable startup is Lozi. The Vietnamese consumer-to-consumer ecommerce portal announced last October that it had secured an eight-digit investment. The company is now setting its sights on becoming a one-stop solution for Vietnamese consumers’ one-hour delivery needs.

Other examples include Telio, a business-to-business platform which raised US$25 million in a series A funding round last December, and Leflair, which raised US$7 million in January 2019 to invest in regional expansion.

There are many more fast-growing startups like those three, such as The Gioi SkinFood or Fado.vn. The similarity between these startups is that they all cater to a specific niche market, instead of fighting head-on with online marketplaces.

It seems that as demand for online shopping increases quickly among the Vietnamese, so will their sophistication and expectations. More and more are now looking for specific products, brands, or services that cater to their niches.

This brings about a lot of opportunities for Vietnamese small and medium-sized enterprises as well as ecommerce businesses to excel in 2020 and beyond, as well as opportunities for large players to differentiate themselves and acquire a new competitive edge.

Nguồn: TechinAsia

-

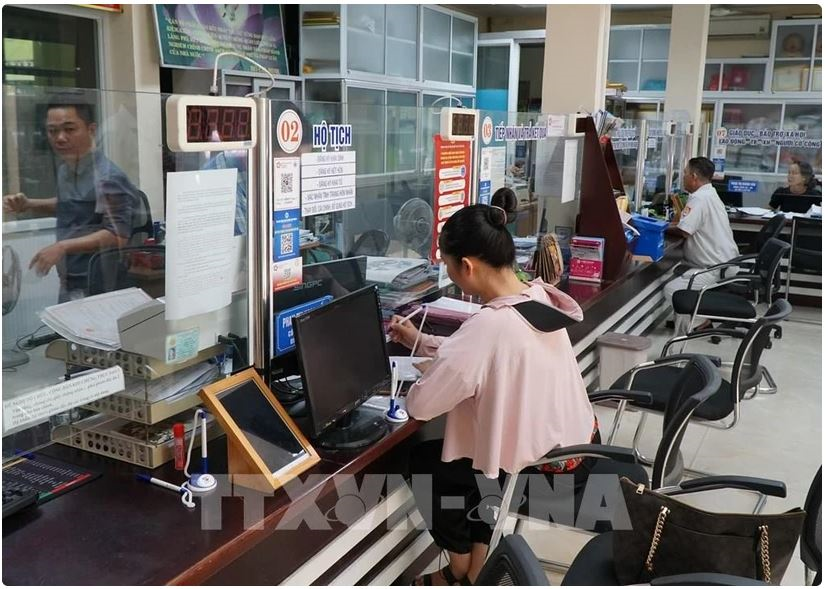

Vietnam harnesses AI to transform public services27/03/2025The Government is accelerating AI application to reduce the paper workload and improve operation efficacy.

Vietnam harnesses AI to transform public services27/03/2025The Government is accelerating AI application to reduce the paper workload and improve operation efficacy. -

Government steering committee set up to drive Vietnam’s sci-tech, innovation development18/03/2025It is tasked with studying and proposing the Government and the PM national strategies, policies, and solutions for developing science, technology, innovation and digital transformation. Besides, it is in charge of overseeing the implementation of project No. 06 on developing the application of population data, identification, and e-authentication data, as well as administrative reform efforts.

Government steering committee set up to drive Vietnam’s sci-tech, innovation development18/03/2025It is tasked with studying and proposing the Government and the PM national strategies, policies, and solutions for developing science, technology, innovation and digital transformation. Besides, it is in charge of overseeing the implementation of project No. 06 on developing the application of population data, identification, and e-authentication data, as well as administrative reform efforts. -

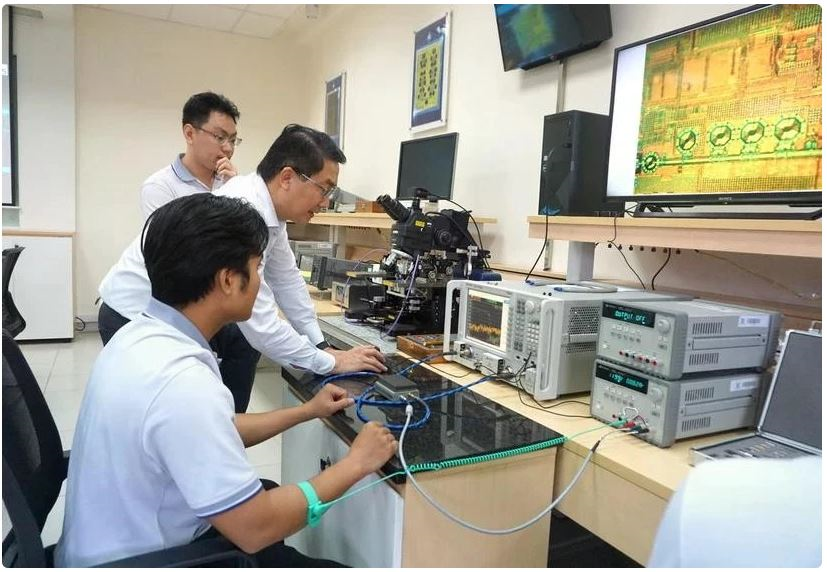

Innovation – breakthrough path for Vietnam’s development: experts10/03/2025Experts in Singapore believe that innovation represents a breakthrough path for Vietnam, which is advancing to the new era - that of the nation's rise.

Innovation – breakthrough path for Vietnam’s development: experts10/03/2025Experts in Singapore believe that innovation represents a breakthrough path for Vietnam, which is advancing to the new era - that of the nation's rise. -

Decisively cutting administrative procedures to facilitate businesses’ operations06/03/2025During a recent working session with representatives of the Party Central Committee’s Commission for Policies and Strategies, Party General Secretary To Lam urged greater efforts to position Vietnam's investment environment among the top three in ASEAN within the next two to three years.

Decisively cutting administrative procedures to facilitate businesses’ operations06/03/2025During a recent working session with representatives of the Party Central Committee’s Commission for Policies and Strategies, Party General Secretary To Lam urged greater efforts to position Vietnam's investment environment among the top three in ASEAN within the next two to three years. -

Vietnam urged to seize digital transformation opportunities21/02/2025Experts highlighted a young population, the Government's support, and a thriving startup ecosystem are driving the country’s innovation.

Vietnam urged to seize digital transformation opportunities21/02/2025Experts highlighted a young population, the Government's support, and a thriving startup ecosystem are driving the country’s innovation.