-

8 trends that will shape Southeast Asian ecommerce in 201907/03/2019EcommerceIQ is the research arm of aCommerce. All brands and companies mentioned below are affiliated with aCommerce in one way or the other.

8 trends that will shape Southeast Asian ecommerce in 201907/03/2019EcommerceIQ is the research arm of aCommerce. All brands and companies mentioned below are affiliated with aCommerce in one way or the other.

US$102 billion. That’s the estimated value for Southeast Asian ecommerce in 2025.

Google and Temasek’s e-Conomy of Southeast Asia report confirmed the growing confidence among investors in the region. Startups raised US$9.1 billion in the first half of last year – almost as much as throughout the whole of 2017.

With 2018 dubbed the year of ecommerce for the region, what can we expect in 2019? EcommerceIQ spoke to industry leaders to find out the anticipated trends for online retailers and brands in Southeast Asia.

1. Brands are shifting from data gathering to data utilization

The biggest difference of online retail from offline is the ability to track, collect, monitor, and manage information – all in real time.

Through online channels, brands are able to access customer data through chat, social media, and their own websites. This information can be used to devise online strategies. Globally, 73 percent of brands plan to allocate their ecommerce budget on data and analytics services in 2019.

However, despite its obvious importance, many brands still have no concept of how to use data to their advantage.

“Even today, not all retailers have embraced data fully to the point where they think of themselves as data companies. And this might be why many companies are suffering,” wrote Srikant M. Datar, a Harvard Business School professor.

Data collection is easy, but having the analytics capability and optimizing it to use data is a completely different ball game.

A survey by ecommerceIQ identified data analysis as one of the most difficult skills to find among digital talents in Southeast Asia. Brands are constantly searching for data aggregators to consolidate information for convenient retrieval and use to target, re-target, and personalize products and services.

Reagan Chai, head of regional business intelligence and development at Shopee, told ecommerceIQ that data acquisition enables the company to map out and optimize buyer and seller user experience while preempting customer demand and anticipating future potential. The company has seen an increase in website traffic in the past year, which it claims even surpasses that of other regional players.

In China, Alibaba and JD have taken a step further by using the data gathered online to improve inventories and experiences at their physical stores. Chris Tung, chief marketing officer at Alibaba, said the company wants to help brands find the right consumers by tracking them through its system.

“We’re finding all data that has to do with people, their behavior, what they like, what they buy, and binding this online data to real people,” Tung explains.

Recognizing the need, aCommerce – ecommerce enabler and ecommerceIQ’s parent company – launched a data analytics platform called BrandIQ last year. It aims to help brands centralize customer data and offer customized products or services to each target group.

All of this leaves brands with two options: find an economical way to use data, or continue looking for a needle in a haystack.

2. Social commerce channels are becoming brands’ new sales outlets

Social commerce in the region boomed before ecommerce grew to how we know it now.

For example, Facebook Groups have long been established as an online space where people can connect to buy and sell goods – even before Marketplace was launched. The social network’s rapid growth in Southeast Asia is propelled by mobile adoption, where 90 percent of the online population access the internet via smartphones. Some even see Facebook as the internet itself.

With multitudes of potential customers gathered on social media platforms, brands have naturally identified alternative sales channels. Following Facebook’s footsteps, the likes of Instagram and Pinterest have also developed their own shopping features.

“Brands will miss out if they don’t have a social media presence. The best way to get feedback from consumers is by having a direct conversation,” Deb Liu, vice president of Facebook Marketplace, told Forbes.

Meanwhile, messaging app Line recently acquired a social commerce management startup called Sellsuki in Thailand, where it has the second biggest user base, to build a strong foundation for its ecommerce business.

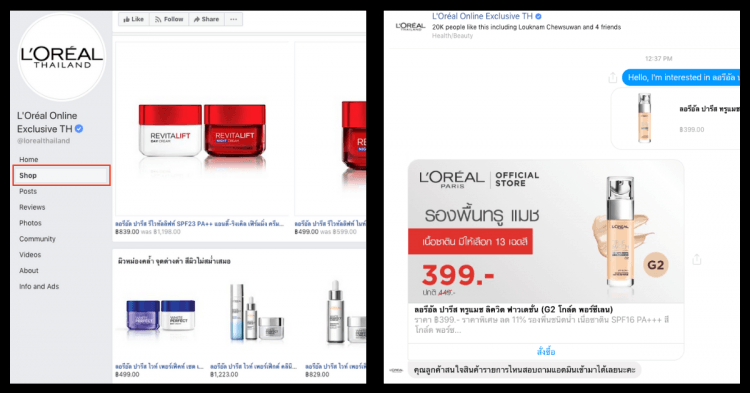

Consumers can purchase L’Oreal products on the cosmetic giant’s Facebook page, assisted through the Messenger app until checkout

A few big brands like L’Oreal have already equipped their social media page with the Shop feature, which allows consumers to make a purchase directly on the page. And it’s only a matter of time before more brands follow suit and use social media as one of their sales channels, removing one unnecessary layer between them and consumers.

3. E-marketplaces are launching new services to differentiate

One key factor that successful ecommerce players in more developed markets share is rolling out various services on their own supply chains.

JD’s investment in developing its own supply chain allows the company to scale its technology and offer a retail-as-a-service (RaaS) proposition to help other retailers or brands sell online. Alibaba’s ecosystem is unrivaled: it goes beyond commerce to include a logistics network (Cainiao) and a payment firm (Ant Financial). Recently, it also ventured into the entertainment industry.

The same practice has spread to Southeast Asia. Lazada has strengthened its logistics arm FBL (which stands for Fulfilled by Lazada) post-acquisition. And although no concrete plans have been disclosed, Shopee has expressed its intention to build its own logistics network. (In Shopee’s statement, Shopee Thailand does not have a solid plan to build its own logistics network yet. The comment was briefly mentioned in the interview with Bangkok Post and was made a focal point by the media.)

Singapore’s Qoo10 is expected to launch its blockchain-based ecommerce site QuuBee this year. It seeks to leverage blockchain to eliminate transaction and listing fees, which could help increase retailers’ profit margins, making for a more sustainable approach to commerce.

In Indonesia, Tokopedia is set to offer infrastructure-as-a-service with a fresh US$1.1 billion funding. They also plan to use AI for customer care services and run credit checks on merchants seeking loans for business expansion.

But it’s not only the general e-marketplaces that are making such moves. Fashion e-marketplace Zilingo scored US$226 million in funding as it builds a network of fashion supply chain that anyone – small merchants or big retailers – can tap into.

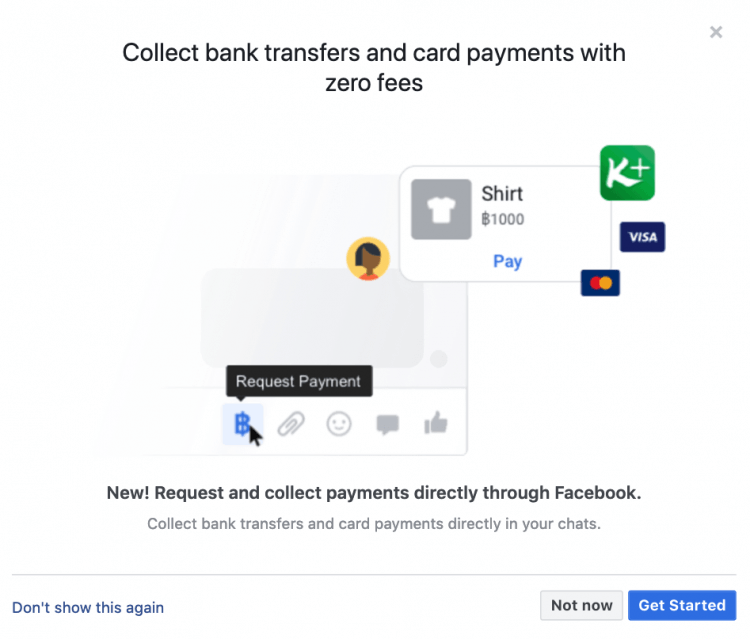

Facebook is also showing signs that it will jump into the bandwagon. The social network launched the Marketplace feature in Thailand and Singapore without much fanfare. But its recent partnership with Kasikorn Bank in Thailand to allow in-app payment feature might be the start of the company’s effort to bulk up its commerce capabilities and cater to those who use the platform for business.

Facebook partners with Thailand’s Kasikorn Bank to enable transfers and card payments on Messenger

We anticipate that e-marketplaces will continue to go head-to-head through new services, acquisitions, and partnerships in a bid to recruit more brands to sell on their platforms.

Ready to burn more cash to win in this battle, e-marketplaces?

4. Brands will reinforce reviews and fund user-generated content to win consumers

E-marketplaces in Southeast Asia has been upscaling and building add-ons that provide consumers with the utmost convenience. The search for better technology and assistance for consumers is constant and never-ending.

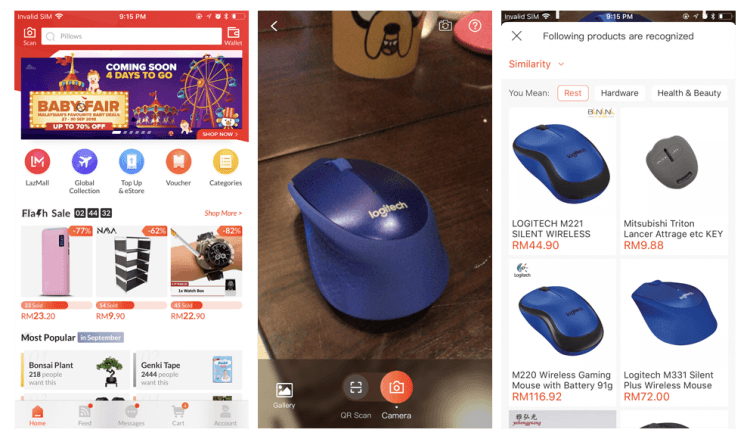

Lazada has introduced an AI-powered image search feature, where shoppers can take a picture of an item and receive suggestions on similar available items

Consumers begin their online purchasing journey by searching for product information or reading reviews usually on e-marketplaces before making a decision. They can also look for real opinions to validate products.

The habit of leaving product reviews on ecommerce platforms is not as common in Southeast Asia as it is in the US – Amazon even created a dedicated page for top reviewers. And when consumers in Southeast Asia do, the reviews often contain little information about the product and more about other aspects (i.e. delivery time and packaging, among others).

The community-crowd model, which is popular with travel platforms such as Airbnb, might also be suitable for ecommerce businesses in Southeast Asia to alleviate consumers’ apprehension towards online shopping. It’s something that Edouard Steinert, director of channel management at aCommerce Thailand, is investigating, given that the model could save time, increase results, and keep costs low.

“Consumers today want to hear genuine feedback and reviews about a product and become more averse to hard-sell methods. [User-generated] reviews, especially from people who share the same passion with them, proved to drive better conversion for the brand,” he says.

5. Brands are using direct-to-consumer strategies to acquire consumer data

In 2014, it was estimated that 89 percent of companies would compete mostly on the customer experience front. The direct-to-consumer (DTC) approach is also becoming more important for brands as it allows them to gain insights into their end users and their needs.

One rising trend is ecommerce subscription. From a consumer perspective, subscription offers a convenient, personalized, and often cheaper way to buy what they need. But for brands, it’s a subtle method to create customer loyalty.

One brand adopting this strategy in the region is Nescafe Dolce Gusto, which offers free coffee machines in exchange for a minimum of a 12-month subscription. Besides witnessing sales growth, it also noticed that consumers continued to purchase from the brand despite dropping out of the subscription plan.

“A subscription strategy is not just a long-term consumption enabler but also a consumer acquisition channel for the whole brand,” says Bhuree Ackarapolpanich, brand director and digital expert at Nescafe Dolce Gusto.

Mandy Arbilo, regional director of project management at aCommerce, said e-sampling is also a popular strategy that brands use to evaluate the demand, especially in ecommerce. While normal sampling techniques used by offline retailers are expensive, e-sampling saves brands up to 40 percent and also provides essential customer data.

As DTC becomes widely adopted, consumers will see brands coming up with attractive gimmicks using digital tools to gain insights and entice consumers to spend more on their brands.

6. Regulation of ecommerce across the region will finally happen in 2019

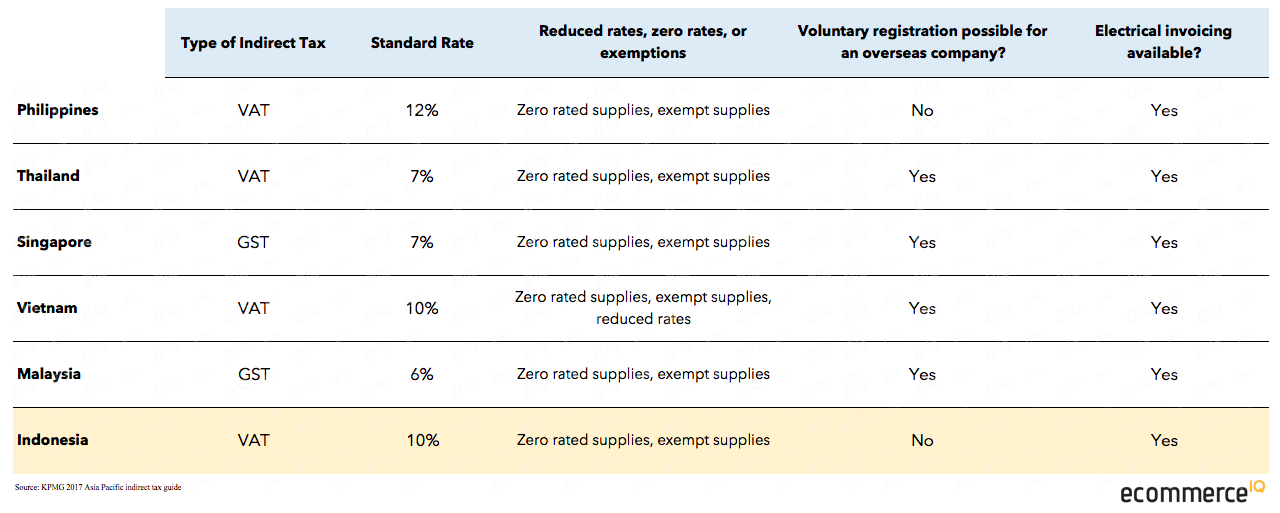

Ecommerce in Southeast Asia has remained largely unregulated. As the industry grows, it is only a matter of time until governments step in to tax this fast-growing segment and level the playing field for foreign companies to offer digital services and goods locally.

News about the ecommerce tax has been floating around since the beginning of last year, but nothing concrete has actually materialized.

A couple of months ago, economic ministers from the ASEAN signed an agreement to facilitate cross-border ecommerce transactions within the region. However, while nothing has been written in stone, predictions abound concerning the impact of ecommerce tax on imported goods into the region.

In Indonesia and Thailand, ecommerce tax is predicted to bolster the growth of social commerce because, unlike marketplaces, they are uncontrolled.

“If tax regulations restrict ecommerce platforms, making selling in Bukalapak complicated, there will be an exodus of people who prefer selling on Instagram and Facebook. These platforms are uncontrolled and not chased for tax because they sell through the back door,” said Muhamad Fajrin Rasyid, co-founder and chief financial officer at Bukalapak.

Singapore might also see a decrease in cross-border shopping as prices increase with the introduction of Goods and Service Tax (GST) on ecommerce goods and services from overseas. Currently, 89 percent of all cross-border transactions in Asia Pacific are conducted by Singaporeans.

A snapshot of the state of ecommerce tax regulations across six major Southeast Asian markets

Another high-potential ecommerce market, India has introduced new e-marketplace laws that prohibit marketplace “owners” to sell products on their own marketplace through vendor entities where they have an equity interest. The country has also banned deals with sellers that grant marketplaces exclusivity rights to products.

Could we see such laws in Southeast Asia? Regardless of such moves, brands will have very little influence on how new tax policies take root. But it behooves them to anticipate similar rulings and adjust online strategy accordingly to mitigate the impact from a possible shift in customer behavior.

The ASEAN agreement will encourage more local entrepreneurs to create new products and venture online to access a larger and more diverse market. Brands will now need to be nimble and innovative to adapt to local nuances and preferences.

7. Grab and Go-Jek are challenging logistics providers to capture ecommerce and online food delivery

With Go-Jek’s recent efforts to expand into Southeast Asia, the competition between the Indonesian startup and its rival Grab will only get fiercer. Go-Jek has successfully carved its existence in Vietnam, Singapore, and Thailand last year alone. And Dacsee, Grab’s competitor in Malaysia, has also announced its plan to expand to Thailand.

But Go-Jek and Grab are not just racing to be the best ride-hailing providers. Instead, they’re aiming to become something much bigger: super apps. Go-Jek has secured US$1 billion funding from Google, Tencent, and JD as part of its plan to raise US$2 billion for this venture. Meanwhile, Grab recently nabbed US$200 million investment from Thailand’s Central Group, boosting its valuation to US$11 billion to date.

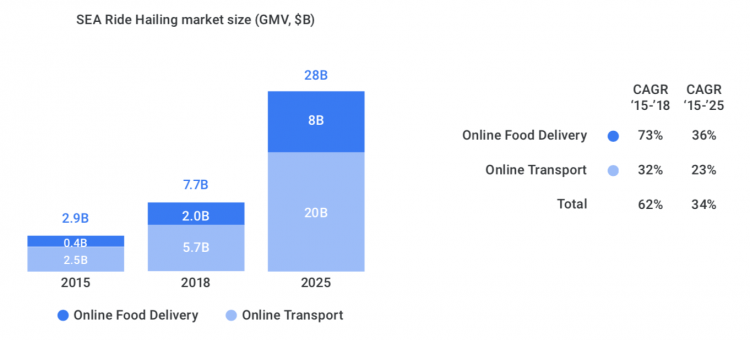

2019 will see these two competitors steer towards the same goal for food and ecommerce delivery. Google and Temasek reported that the online food-delivery business grew 73 percent CAGR in 2018. By 2025, they predict that the online food-delivery growth will be at 36 percent CAGR, with online transport at only 23 percent.

The market size of the ride-hailing industry in Southeast Asia, according to Google and Temasek’s e-Conomy SEA 2018 Report

Same-day delivery providers will also see more competition in 2019. The impact of Grab and Go-Jek on market vibes will definitely raise the bar for the logistics and delivery sectors.

8. Brands and retailers will double down on omnichannel

Omnichannel shopping experience is not a new concept, but companies do have diverse interpretations for it.

Online retail behemoths, such as Amazon and Alibaba, are moving into physical retail. The main reason why Alibaba ventured out of online space reflects its determination to solve core problems of the shopping experience, such as scattered operations and lack of payment transparency.

JD pipped Alibaba for once by opening the first unmanned convenience store in the region in Jakarta to leverage its enormous database and offer brands insights, such as the best products to stock and advertise. Through its joint venture with Central Group in Thailand, JD Central is also planning a similar launch in the country by 2020.

Inside JD.ID X Mart in Indonesia. It is JD’s first unmanned store outside of China, a demonstration of the company’s mission to implement RaaS

Pure-play ecommerce retailers and brands recognized drawbacks in online marketing channels, with fragmented infrastructure and a limited pool of shoppers. Promoting offline is then an attractive option to push sales growth.

Elsewhere in Southeast Asia, companies are slowly but surely adopting this strategy across all categories. Ecommerce fashion players like Thailand’s Pomelo and Singapore’s Love Bonito have opened physical stores in their respective countries.

In 2018, Pomelo opened five new outlets, moving away from Bangkok’s prime shopping areas and into central business districts and residential areas. Meanwhile, Love Bonito has 17 retail outlets spread across Singapore, Malaysia, Indonesia, and Cambodia.

“Data can tell you what’s selling, but being on the ground tells you why something is not selling and what the customer is looking for,” Rachel Lim, co-founder of Love Bonito, told Peak Magazine.

Visiting shopping malls is a popular social activity in Southeast Asia – a trend that’s not set to disappear anytime soon. Brands should take advantage of a dual presence in the online and physical worlds.

Nguồn: Tech in Asia

-

Vietnam harnesses AI to transform public services27/03/2025The Government is accelerating AI application to reduce the paper workload and improve operation efficacy.

Vietnam harnesses AI to transform public services27/03/2025The Government is accelerating AI application to reduce the paper workload and improve operation efficacy. -

Government steering committee set up to drive Vietnam’s sci-tech, innovation development18/03/2025It is tasked with studying and proposing the Government and the PM national strategies, policies, and solutions for developing science, technology, innovation and digital transformation. Besides, it is in charge of overseeing the implementation of project No. 06 on developing the application of population data, identification, and e-authentication data, as well as administrative reform efforts.

Government steering committee set up to drive Vietnam’s sci-tech, innovation development18/03/2025It is tasked with studying and proposing the Government and the PM national strategies, policies, and solutions for developing science, technology, innovation and digital transformation. Besides, it is in charge of overseeing the implementation of project No. 06 on developing the application of population data, identification, and e-authentication data, as well as administrative reform efforts. -

Innovation – breakthrough path for Vietnam’s development: experts10/03/2025Experts in Singapore believe that innovation represents a breakthrough path for Vietnam, which is advancing to the new era - that of the nation's rise.

Innovation – breakthrough path for Vietnam’s development: experts10/03/2025Experts in Singapore believe that innovation represents a breakthrough path for Vietnam, which is advancing to the new era - that of the nation's rise. -

Decisively cutting administrative procedures to facilitate businesses’ operations06/03/2025During a recent working session with representatives of the Party Central Committee’s Commission for Policies and Strategies, Party General Secretary To Lam urged greater efforts to position Vietnam's investment environment among the top three in ASEAN within the next two to three years.

Decisively cutting administrative procedures to facilitate businesses’ operations06/03/2025During a recent working session with representatives of the Party Central Committee’s Commission for Policies and Strategies, Party General Secretary To Lam urged greater efforts to position Vietnam's investment environment among the top three in ASEAN within the next two to three years. -

Vietnam urged to seize digital transformation opportunities21/02/2025Experts highlighted a young population, the Government's support, and a thriving startup ecosystem are driving the country’s innovation.

Vietnam urged to seize digital transformation opportunities21/02/2025Experts highlighted a young population, the Government's support, and a thriving startup ecosystem are driving the country’s innovation.