-

Succeeding in a connected future23/03/2023From virtual health consultations to engineering schematics rendered as digital twins, enterprises and governments are turning to new technologies to adapt, build resilience, meet customers’ and society’s expectations, and tap into new markets.

Succeeding in a connected future23/03/2023From virtual health consultations to engineering schematics rendered as digital twins, enterprises and governments are turning to new technologies to adapt, build resilience, meet customers’ and society’s expectations, and tap into new markets.

This expanded technology consumption has driven operating and maintenance costs for the IT suite on what seems to be a never-ending upward trajectory. Additionally, organisations must always understand and comply with rapidly changing and complex regulatory regimes.

“Digital transformation has accelerated in the Asia Pacific over the past three years. While many organisations have started to address the changing landscape through digitisation, there is still much to do for the region to maintain its competitive position. The years between now and the end of this decade will require increased investment and innovation so the region can establish itself as a technology leader. The region will also require deep expertise in building scaled network effects, agile IT investment models, and increased confidence in data analytics to make effective decisions,”said Rob Le Busque, Regional Vice President, Asia Pacific at Verizon Business Group.

“Leaders must now bring all the elements together across siloed processes and embrace new ways of working. This requires strategies that bring together disconnected systems to create powerful, scalable platforms that enable innovation and order-of-magnitude change,” continued Le Busque.

Enterprise Intelligence – the roadmap to game-changing technology

.jpg)

Source: Shutterstock

Having a digital advantage in the future requires unlocking insights from within the enterprise. Enterprise Intelligence is an approach that unites disconnected parts of the business and enables secure, smarter insights and more informed decision-making. It also requires new technologies that enable immediate and empathetic interactions with partners, suppliers and customers. This approach creates greater intelligence through systems that deliver ultra-personalised and engaging connections through natural language, interactive commands and, sometimes, by interpreting emotions.

These immersive capabilities create exciting new opportunities, but present a challenge to most organisations to build an effective roadmap. To achieve this requires that organisations, and particularly their CIOs, ask large strategic questions, and reassess business goals and objectives accordingly.

Asset-intensive industries will see significant investment that will help fuel digital opportunities across both core and new operating areas. In the Asia Pacific region, these include manufacturing, retail and consumer packaged goods (CPG), as well as public sector and critical infrastructure providers.

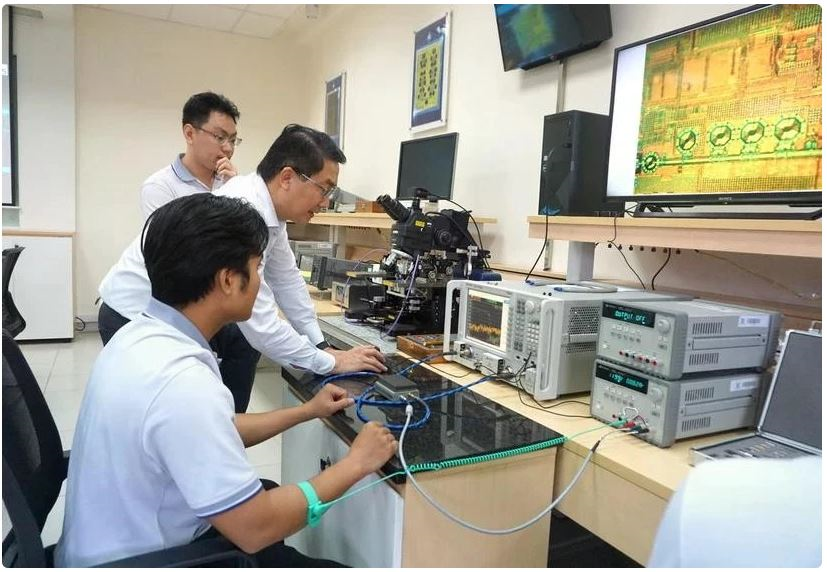

Giving manufacturers an edge

By accelerating its digital transformation, the manufacturing sector has a particular opportunity to solve many of its key challenges. These include thriving in new regional and global markets, fending off threats from non-traditional competitors, reducing supply chain risk by increased optionality, and leveraging government investment programs to support infrastructure development.

However, many manufacturing companies are held back by a lack of skills, inertia, legacy business models and a reliance on physical assets.

This is further complicated by the need for these organisations to simultaneously satisfy competing imperatives, including:

- Tapping new sources of data;

- Sharing more data with suppliers, partners, and customers;

- Improving their experiences;

- Strengthening data protection and IT/operational technology (OT)

To date, there is no all-encompassing application that enables all of these outcomes. Instead, it is the combination—or rather the connectedness—of all these capabilities that creates a value multiplier. In much the same way that smartphone developers use the device as a platform for developing compelling experiences, manufacturers can take a platform approach to create the interconnectedness required to streamline business processes. This will in turn increase efficiency and get the job done faster.

Overcoming disenfranchisement in retail and CPG

.jpg)

Source: Shutterstock

There is a common thread between manufacturing and retail in that there needs to be better sharing of data, systems and processes all the way through the value chain. Retailers now need to have readily available data which will allow them to both adapt to changing customer desires and enhance their supply chain’s ability to deliver more rapidly.

As Rob Le Busque points out, “Retailers and consumer packaged goods organisations will need to invest in the right technologies and business models to connect with consumers to meet their specific individual expectations.”

During the coronavirus pandemic, there was a wholesale shift to digital-first retail experiences. This created vast banks of consumer data that didn’t previously exist. Those retailers who executed, or accelerated, a digital retail strategy now have a wealth of customer intent, demographic and purchasing data not previously available to them. The question now becomes how this data can be leveraged in a compliant way to create richer and more valuable retail experiences, while generating a corresponding increase in revenue.

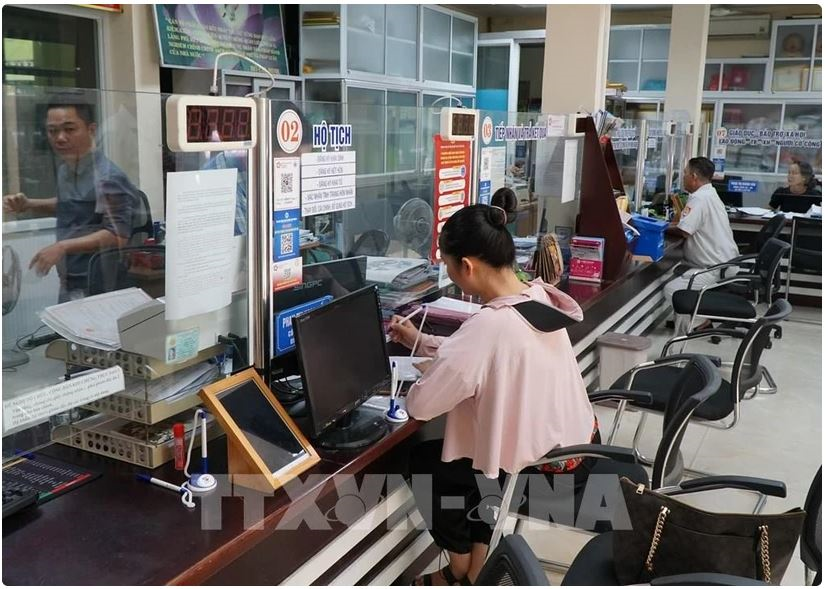

Public services and critical infrastructure

Source: Shutterstock

The public sector is also looking at ways to manage Enterprise Intelligence challenges—from local planning and people movement in urban settings, all the way to addressing vulnerabilities in national critical infrastructure supply chains.

Recently a German town purchased a private 5G network from Verizon to manage the town’s entire ecosystem—from traffic lights and security cameras, to providing a connected campus network. This technology helped town planners understand where large volumes of people congregate and, ultimately, how to manage security and services more efficiently.

Verizon has also delivered connectivity to Associated British Ports (ABP) at the Port of Southampton, the U.K.’s number one automotive port in 2014, which handles 600,000 vehicles per year and £40 billion in exports annually. With pressure on ports—and all links in the supply chain—being possibly higher than ever, ABP needed to streamline its processes with new technology.

ABP reached out to Verizon to deploy a Private 5G Network, enabling the port to capture, process and analyse large quantities of data quickly and securely. ABP can now keep better track of vehicles, allowing the port authority to move products off ships, into parking and out to buyers far more efficiently.

Evolving business through Enterprise Intelligence

To remain competitive, businesses today need to reconsider, evolve and collaborate with experienced partners. With deep expertise in networking, cybersecurity, 5G solutions, and services using agile process methodologies, Verizon can help customers connect whole ecosystems. By bringing users and applications together, organisations all over the world are working to achieve all they can imagine, and more.

Nguồn: Tech Wire Asia

-

Vietnam harnesses AI to transform public services27/03/2025The Government is accelerating AI application to reduce the paper workload and improve operation efficacy.

Vietnam harnesses AI to transform public services27/03/2025The Government is accelerating AI application to reduce the paper workload and improve operation efficacy. -

Government steering committee set up to drive Vietnam’s sci-tech, innovation development18/03/2025It is tasked with studying and proposing the Government and the PM national strategies, policies, and solutions for developing science, technology, innovation and digital transformation. Besides, it is in charge of overseeing the implementation of project No. 06 on developing the application of population data, identification, and e-authentication data, as well as administrative reform efforts.

Government steering committee set up to drive Vietnam’s sci-tech, innovation development18/03/2025It is tasked with studying and proposing the Government and the PM national strategies, policies, and solutions for developing science, technology, innovation and digital transformation. Besides, it is in charge of overseeing the implementation of project No. 06 on developing the application of population data, identification, and e-authentication data, as well as administrative reform efforts. -

Innovation – breakthrough path for Vietnam’s development: experts10/03/2025Experts in Singapore believe that innovation represents a breakthrough path for Vietnam, which is advancing to the new era - that of the nation's rise.

Innovation – breakthrough path for Vietnam’s development: experts10/03/2025Experts in Singapore believe that innovation represents a breakthrough path for Vietnam, which is advancing to the new era - that of the nation's rise. -

Decisively cutting administrative procedures to facilitate businesses’ operations06/03/2025During a recent working session with representatives of the Party Central Committee’s Commission for Policies and Strategies, Party General Secretary To Lam urged greater efforts to position Vietnam's investment environment among the top three in ASEAN within the next two to three years.

Decisively cutting administrative procedures to facilitate businesses’ operations06/03/2025During a recent working session with representatives of the Party Central Committee’s Commission for Policies and Strategies, Party General Secretary To Lam urged greater efforts to position Vietnam's investment environment among the top three in ASEAN within the next two to three years. -

Vietnam urged to seize digital transformation opportunities21/02/2025Experts highlighted a young population, the Government's support, and a thriving startup ecosystem are driving the country’s innovation.

Vietnam urged to seize digital transformation opportunities21/02/2025Experts highlighted a young population, the Government's support, and a thriving startup ecosystem are driving the country’s innovation.