-

Cashless payments are here to stay14/04/2022Cashless payments have become a norm in many countries in recent years, bringing great benefits to individuals in the payment process.

Cashless payments are here to stay14/04/2022Cashless payments have become a norm in many countries in recent years, bringing great benefits to individuals in the payment process.

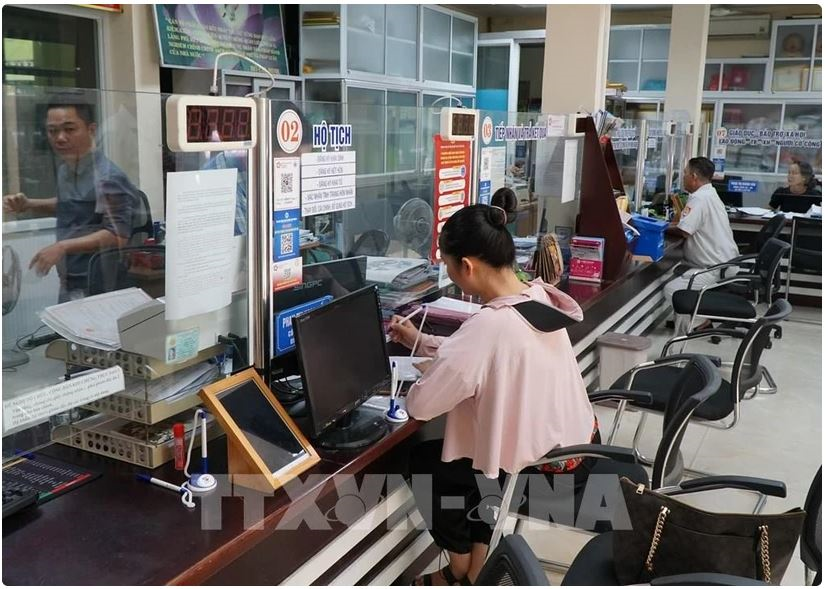

Hanoi (VNS/VNA) - Cashless payments have become a norm in many countries in recent years, bringing great benefits to individuals in the payment process.

This remark was made by Editor-in-chief of Tien Phong newspaper Le Xuan Son in a webinar on digital payments on April 13.

Son underlined the pandemic as a key factor that has promoted non-cash payments in Vietnam over the past two years.

Banks have shifted their focus to these methods of payments and reaped great success.

To further promote digital transformation in the banking system, he called for a favourable environment and a suitable technology infrastructure to encourage more clients to change their payment habits.

“Cashless payments are novel methods of payment. Unfortunately, a majority of the Vietnamese population still do not have access to technology,” he said.

Le Van Tuyen, deputy director of the Payment Department under the State Bank of Vietnam, revealed that the Government Project on Cashless Payments in Vietnam between 2021 and 2025 has four major objectives.

First, the project aims to make non-cash payments a norm in urban areas and expand their coverage in rural areas.

Second, it seeks to develop safe non-cash payment infrastructure with various conveniences and facilities to meet the rising demand of firms and individuals.

Third, it strives to enhance the security and transparency of cashless payments, allowing authorities to better monitor economic transactions in the country.

Lastly, it aims to realise growth targets set for non-cash payments in the short term, including 50 percent of transactions on e-commerce platforms being conducted through cashless payments and economic transactions via smartphones growing at 50-80 percent per year.

Nguyen Quang Minh, deputy general director of the National Payment Services Corp. (Napas), noted that his corporation had developed various financial solutions to promote cashless payments in Vietnam.

Notably, it has introduced multi-purpose chip cards that are compatible with applications from different fields, including healthcare and insurance, allowing cardholders to easily make payments in such fields.

However, he also admitted that current payment acceptance networks are inadequate to meet the demand of a market of nearly 100 million.

“For this reason, Napas, banks and financial intermediaries will cooperate to expand payment acceptance networks in the near future,” he added.

Pham Thi Mai Anh, director of the Digital Banking Service Centre at Military Bank, claimed that her bank was the first to cooperate with Napas in the roll-out of QR Code payments, notably VietQR.

“We are continuing to promote VietQR among sellers in local marketplaces to expand its coverage,” she added.

The director also revealed that her bank’s virtual cards would target young people, which are the driving force behind the growth of digital payments.

Hoang Xuan Que, director of the Finance and Banking Institute at the National Economic University, highlighted non-cash payments as an inevitable global trend and Vietnam is no exception.

In the near future, cashless payments will move at a faster pace thanks to better technology infrastructure and cheaper smartphones.

“Many Vietnamese families have opted for cashless payments to pay their bills and tuition fees of their children. This indicates that it is time to step up non-cash payments in the country,” he added.

The director also anticipated that 100 percent of undergraduates would switch to chip cards in the near future and their payment habits would affect their families, drawing more clients to the new methods of payment./.

Nguồn: VNA

-

Vietnam harnesses AI to transform public services27/03/2025The Government is accelerating AI application to reduce the paper workload and improve operation efficacy.

Vietnam harnesses AI to transform public services27/03/2025The Government is accelerating AI application to reduce the paper workload and improve operation efficacy. -

Government steering committee set up to drive Vietnam’s sci-tech, innovation development18/03/2025It is tasked with studying and proposing the Government and the PM national strategies, policies, and solutions for developing science, technology, innovation and digital transformation. Besides, it is in charge of overseeing the implementation of project No. 06 on developing the application of population data, identification, and e-authentication data, as well as administrative reform efforts.

Government steering committee set up to drive Vietnam’s sci-tech, innovation development18/03/2025It is tasked with studying and proposing the Government and the PM national strategies, policies, and solutions for developing science, technology, innovation and digital transformation. Besides, it is in charge of overseeing the implementation of project No. 06 on developing the application of population data, identification, and e-authentication data, as well as administrative reform efforts. -

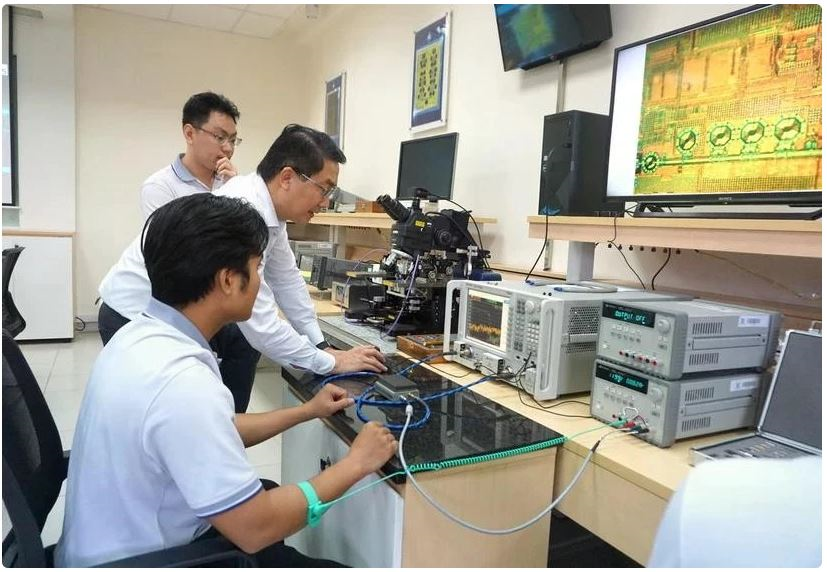

Innovation – breakthrough path for Vietnam’s development: experts10/03/2025Experts in Singapore believe that innovation represents a breakthrough path for Vietnam, which is advancing to the new era - that of the nation's rise.

Innovation – breakthrough path for Vietnam’s development: experts10/03/2025Experts in Singapore believe that innovation represents a breakthrough path for Vietnam, which is advancing to the new era - that of the nation's rise. -

Decisively cutting administrative procedures to facilitate businesses’ operations06/03/2025During a recent working session with representatives of the Party Central Committee’s Commission for Policies and Strategies, Party General Secretary To Lam urged greater efforts to position Vietnam's investment environment among the top three in ASEAN within the next two to three years.

Decisively cutting administrative procedures to facilitate businesses’ operations06/03/2025During a recent working session with representatives of the Party Central Committee’s Commission for Policies and Strategies, Party General Secretary To Lam urged greater efforts to position Vietnam's investment environment among the top three in ASEAN within the next two to three years. -

Vietnam urged to seize digital transformation opportunities21/02/2025Experts highlighted a young population, the Government's support, and a thriving startup ecosystem are driving the country’s innovation.

Vietnam urged to seize digital transformation opportunities21/02/2025Experts highlighted a young population, the Government's support, and a thriving startup ecosystem are driving the country’s innovation.