-

E-commerce is here to stay and growing strong despite the return of brick-and-mortar stores10/03/2023With the easing of Covid-19 restrictions and pressures building from the inflation rate rise, 2023 is shaping up to be a challenging year for online retailers. Yet, despite the multitude of challenges, the e-commerce industry in Asia Pacific still saw a growth of 12.53% to US$3,468.6 billion in 2022. Looking into the year ahead, the future for e-commerce sales in Asia-Pacific is promising, with an expected growth of CAGR 10.24% from 2022-2027.

E-commerce is here to stay and growing strong despite the return of brick-and-mortar stores10/03/2023With the easing of Covid-19 restrictions and pressures building from the inflation rate rise, 2023 is shaping up to be a challenging year for online retailers. Yet, despite the multitude of challenges, the e-commerce industry in Asia Pacific still saw a growth of 12.53% to US$3,468.6 billion in 2022. Looking into the year ahead, the future for e-commerce sales in Asia-Pacific is promising, with an expected growth of CAGR 10.24% from 2022-2027.

As we embrace the post-pandemic world with the easing of Covid-19 restrictions worldwide, the retail industry is once again adopting an omni-channel approach, to strike a balance between online and offline shopping. More consumers are now reconnecting to brick-and-mortar stores for the immersive offline commerce experience that was once missed. Hence, in such a saturated industry, e-commerce players need to navigate the space by stepping up and ensuring they have a competitive edge.

As we kickstart 2023, commerce players across different vertical industries need to have a strong understanding of the rapidly evolving retail landscape and demands of consumers in order to remain attractive. Here are some emerging trends we see the commerce industry shifting toward in the coming year.

The rise of social commerce

More than just for entertainment and a way to kill time, social media platforms are now the main source of information for many – news, communication, and advertisements. Social commerce is now added to that list.

Social commerce departs from traditional e-commerce by integrating buying and selling into daily life and creates a community of shoppers with similar interests. Utilizing social platforms such as Instagram, TikTok, and Facebook, social commerce reduces the barriers to entry for consumers and sellers alike, allowing more opportunities for the ecosystem to grow. In fact, social commerce is expected to grow three times faster than traditional e-commerce, generating $1.2 trillion by 2025.

The reason for its success is simple, and it lies in its name – social. Consumers are easily influenced by the people around them and are more likely to be convinced by their community to make a purchase compared to traditional digital advertisements. It levels the playing field for individual sellers and small businesses by allowing them to tap into organic social growth and word-of-mouth advertising to directly reach their audience. Most importantly, brands can now capture first-party data on customer’s social habits as data is centralized in one place, which helps inform their sales strategy.

However, brands will need to be cautious about jumping on the next bandwagon. When approaching social commerce, consumers want to be engaged by the content provided. As such, brands that adopt live streaming sales should be prepared to invest in high production and entertainment value, especially for luxury brands like Louis Vuitton. Compared to traditional e-commerce, sellers might also experience a higher return rate for purchases as consumers may have a higher tendency to buy on impulse, which creates an added complexity of managing the logistics of returned goods.

On the flip side of things, plugging into the e-commerce network can help brands address these challenges as they scale up their social commerce efforts. For instance, social platforms like Tik Tok have partnerships with one of the major logistics companies like J&T Express. The API integration helps brands that are using the platform for social commerce to manage their logistics seamlessly without manual consolidation. Companies and brands have also seen the benefits of partnering integrated storage services providers like Work + Store, which offers additional solutions including a live streaming studio, a packing station, and a seamless last-mile delivery journey. These providers have helped to increase cost savings and efficiency for sellers as they shift or seek to include social commerce in their business with their logistical needs addressed. E-commerce solutions like Shopify and Shopcada can also help to automate order fulfilment and allow for integration with delivery service providers, eliminating unnecessary friction in the e-commerce experience.

Source – Shutterstock

Source – ShutterstockThe emergence of AR/VR technology in e-commerce

While augmented and virtual reality (AR and VR) are more commonly associated with the entertainment sector, it has made its entrance into the e-commerce industry. AR and VR address a key pitfall of online shopping – the inability to replicate the “touch and feel” retail experience of brick-and-mortar stores.

Therefore, e-commerce businesses such as Shopify have tapped into AR to virtually showcase products and recreate a real-world shopping experience for consumers from the comfort of their mobile phones. This has been proven to boost conversion rates and lower the return rates as consumers are more confident in their purchases. Sellers can experiment with creating virtual try-ons and providing product visualization to help consumers picture the product.

Undeniably, brands will have to stay abreast of the latest technologies and consumer trends as they gear up for the new year – but this is just the first step. Innovation and adaptability will remain key to ensuring that they can stay ahead of consumer trends. Through prioritizing consumers at the heart of their business strategies will ultimately allow businesses to build stronger relationships and brand loyalty for the longer term.

Preference for sustainable efforts

Aside from the increasing appetite for interactivity in commerce, there is a growing willingness, especially among younger consumers, to make more environmentally conscious decisions. Sustainability is now a key factor in decision-making over other factors like the brand name, even if it means paying a higher price for a product or brand that engages in environmentally friendly practices. This means beyond cost and quality of products; young consumer groups are focusing more on how companies are working towards having a sustainable supply chain, ensuring that sustainability is even passed on through last mile delivery.

One factor of being a sustainable brand is balancing both the demand for swift and efficient deliveries, as well as the sustainability of their processes. While consumers want to have the best of both worlds, this is easier said than done since ensuring fast delivery might come with the cost of taxing the environment. Since consumers care about whether companies have proper ESG policies, sellers who can deliver their products quickly on top of being sustainable, will stand to gain the most.

Nguồn: Tech Wire Asia

-

Vietnam harnesses AI to transform public services27/03/2025The Government is accelerating AI application to reduce the paper workload and improve operation efficacy.

Vietnam harnesses AI to transform public services27/03/2025The Government is accelerating AI application to reduce the paper workload and improve operation efficacy. -

Government steering committee set up to drive Vietnam’s sci-tech, innovation development18/03/2025It is tasked with studying and proposing the Government and the PM national strategies, policies, and solutions for developing science, technology, innovation and digital transformation. Besides, it is in charge of overseeing the implementation of project No. 06 on developing the application of population data, identification, and e-authentication data, as well as administrative reform efforts.

Government steering committee set up to drive Vietnam’s sci-tech, innovation development18/03/2025It is tasked with studying and proposing the Government and the PM national strategies, policies, and solutions for developing science, technology, innovation and digital transformation. Besides, it is in charge of overseeing the implementation of project No. 06 on developing the application of population data, identification, and e-authentication data, as well as administrative reform efforts. -

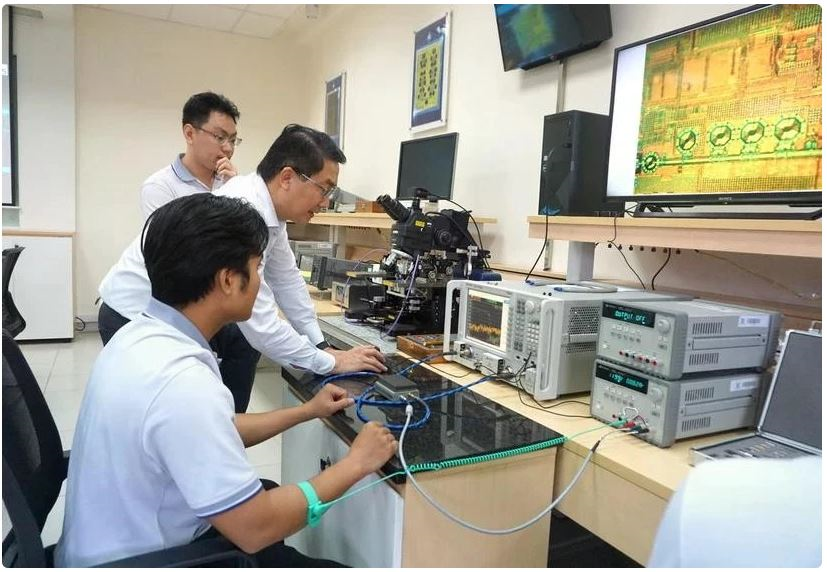

Innovation – breakthrough path for Vietnam’s development: experts10/03/2025Experts in Singapore believe that innovation represents a breakthrough path for Vietnam, which is advancing to the new era - that of the nation's rise.

Innovation – breakthrough path for Vietnam’s development: experts10/03/2025Experts in Singapore believe that innovation represents a breakthrough path for Vietnam, which is advancing to the new era - that of the nation's rise. -

Decisively cutting administrative procedures to facilitate businesses’ operations06/03/2025During a recent working session with representatives of the Party Central Committee’s Commission for Policies and Strategies, Party General Secretary To Lam urged greater efforts to position Vietnam's investment environment among the top three in ASEAN within the next two to three years.

Decisively cutting administrative procedures to facilitate businesses’ operations06/03/2025During a recent working session with representatives of the Party Central Committee’s Commission for Policies and Strategies, Party General Secretary To Lam urged greater efforts to position Vietnam's investment environment among the top three in ASEAN within the next two to three years. -

Vietnam urged to seize digital transformation opportunities21/02/2025Experts highlighted a young population, the Government's support, and a thriving startup ecosystem are driving the country’s innovation.

Vietnam urged to seize digital transformation opportunities21/02/2025Experts highlighted a young population, the Government's support, and a thriving startup ecosystem are driving the country’s innovation.