-

Accelerating digital government services for APAC citizens08/08/2022Digital government services are becoming increasingly popular and in demand in most countries in the Asia Pacific (APAC). While traditional in-person government services used to be the way to get things done, the pandemic has led to a change in approach, not by governments but by the citizens themselves.

Accelerating digital government services for APAC citizens08/08/2022Digital government services are becoming increasingly popular and in demand in most countries in the Asia Pacific (APAC). While traditional in-person government services used to be the way to get things done, the pandemic has led to a change in approach, not by governments but by the citizens themselves.

In fact, according to a new study by Deloitte and commissioned by VMware, APAC citizens are more digitally engaged than ever, but governments still lag in delivering digital services. The “Digital Smart: Advancing digital government for citizens in the Asia-Pacific” study found that the use of in-person government services halved across APAC nations in the last two years, and 77% of citizens now primarily use a digital platform to access government services.

Overall, the report highlighted that 73% of Asia-Pacific citizens believe that government services have become more digital since the onset of the pandemic. 46% of Asia-Pacific citizens are also expecting to access government services more frequently in the future.

For example in Singapore, the report stated that 84% of Singaporean respondents expect to access government services the same or more frequently in the next five years and 76% agree or strongly agree that government needs to invest more in technology to better prepare for the future. Over in Indonesia, 81% of respondents are more comfortable engaging with digital technologies, and notably, government websites have replaced in-person services as the most common medium when accessing government services today.

At the same time, 67% of respondents expected the quality of government services to be on par with those offered by the private sector with 41% of people struggling to access digital services on their own, with a lack of basic digital skills and shortfalls in digital infrastructure.

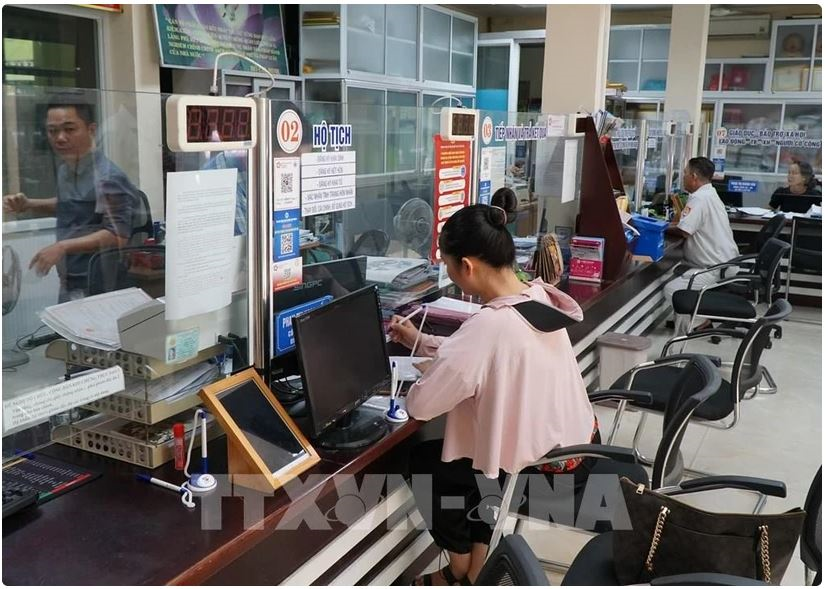

Despite this, in Vietnam, 85% of respondents are willing to learn new digital skills or use a new platform and 80% expect to access government services the same or more frequently in the next five years.

With 900 million new internet users expected to be added to the region (Australia, Singapore, Indonesia, Vietnam, India, Japan, and South Korea) by 2025, the need for investment in digital services by governments continues to grow.

In South Korea and Japan, 90% of respondents in both countries expect to access government services more frequently in the next five years. The report also finds that South Korea is ranked 1st globally on the World Bank GTMI and is recognized as a GovTech world leader with a score of 98 out of 100.

Over in India, respondents are the most likely to say that a positive experience using online government services will improve their trust in government, and currently, 89% are more willing to learn new digital skills or use a new platform.

Australia, which is also slowly increasing its digital government services adoption has 82% of respondents expecting them online over the next five years for a more integrated experience. 55% of Australians are also willing to provide personal data if it makes accessing services easier. Data security is also top of mind for Australians when accessing government services.

For Sylvain Cazard, senior vice president and general manager, Asia Pacific and Japan at VMware, the Deloitte research clearly indicates that citizens expect the same level of services – and quality – as those delivered by private companies or organizations.

“Service delivery in terms of multi-cloud infrastructure as well as modern containerized applications and services are the way forward, so governments also need to align thinking and resourcing along these major trends to meet their citizens’ needs,” commented Cazard.

Deloitte partner, and principal report author, John O’Mahony, added,” The return on investment for digital government services is very significant. It can include positive citizen experiences with digital services, improved perceptions of, and trust, in governments, greater social equality and inclusivity, reduced carbon emissions, possible financial savings, and more responsive governments when policies need to change.”

Currently, government IT spending is forecasted to grow an average of 8% each year to US$151 billion by 2025, outpacing the average growth rate of 6% in overall government spending in Asia-Pacific. This places the public sector in the top five industries in IT spending terms and second after the energy and utility sector in average annual growth in IT spend across Asia-Pacific in 2025.

While the spending on IT increases, governments should also be aware of the potential risks at hand. Increased usage of digital products would require well-planned cybersecurity and data protection framework as well. At the end of the day, the focus should not just be on providing digital government services conveniently but also ensure the service is secured for all.

Nguồn: Tech Wire Asia

-

Vietnam harnesses AI to transform public services27/03/2025The Government is accelerating AI application to reduce the paper workload and improve operation efficacy.

Vietnam harnesses AI to transform public services27/03/2025The Government is accelerating AI application to reduce the paper workload and improve operation efficacy. -

Government steering committee set up to drive Vietnam’s sci-tech, innovation development18/03/2025It is tasked with studying and proposing the Government and the PM national strategies, policies, and solutions for developing science, technology, innovation and digital transformation. Besides, it is in charge of overseeing the implementation of project No. 06 on developing the application of population data, identification, and e-authentication data, as well as administrative reform efforts.

Government steering committee set up to drive Vietnam’s sci-tech, innovation development18/03/2025It is tasked with studying and proposing the Government and the PM national strategies, policies, and solutions for developing science, technology, innovation and digital transformation. Besides, it is in charge of overseeing the implementation of project No. 06 on developing the application of population data, identification, and e-authentication data, as well as administrative reform efforts. -

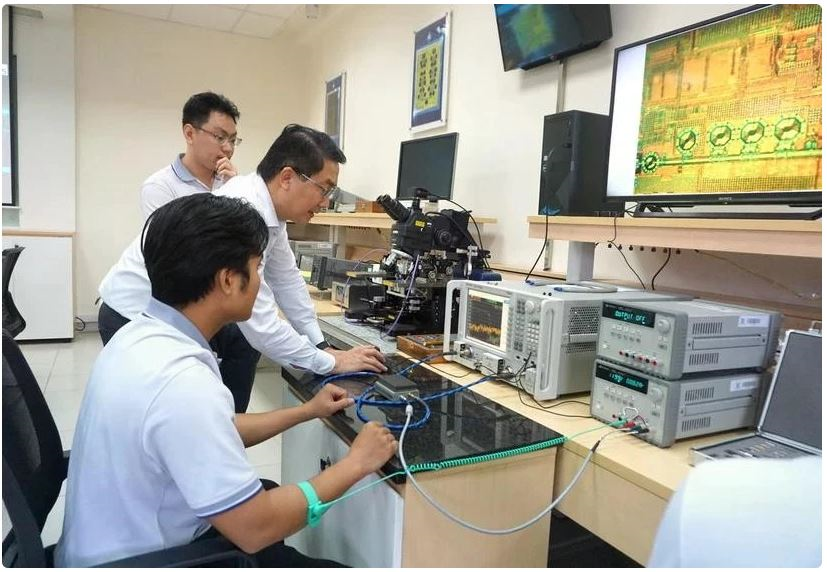

Innovation – breakthrough path for Vietnam’s development: experts10/03/2025Experts in Singapore believe that innovation represents a breakthrough path for Vietnam, which is advancing to the new era - that of the nation's rise.

Innovation – breakthrough path for Vietnam’s development: experts10/03/2025Experts in Singapore believe that innovation represents a breakthrough path for Vietnam, which is advancing to the new era - that of the nation's rise. -

Decisively cutting administrative procedures to facilitate businesses’ operations06/03/2025During a recent working session with representatives of the Party Central Committee’s Commission for Policies and Strategies, Party General Secretary To Lam urged greater efforts to position Vietnam's investment environment among the top three in ASEAN within the next two to three years.

Decisively cutting administrative procedures to facilitate businesses’ operations06/03/2025During a recent working session with representatives of the Party Central Committee’s Commission for Policies and Strategies, Party General Secretary To Lam urged greater efforts to position Vietnam's investment environment among the top three in ASEAN within the next two to three years. -

Vietnam urged to seize digital transformation opportunities21/02/2025Experts highlighted a young population, the Government's support, and a thriving startup ecosystem are driving the country’s innovation.

Vietnam urged to seize digital transformation opportunities21/02/2025Experts highlighted a young population, the Government's support, and a thriving startup ecosystem are driving the country’s innovation.